As an unintentional extension to an earlier post (Dollar Down, Everything Else Up), I want to use this post to highlight the appreciation of gold in particular, against the Dollar. After a brief decline following the credit crisis, Gold has resumed its upward path. It has appreciated 15% year-over-year, and recently cracked $1,000/oz for the only the fourth time in history.

The general factors behind the price of gold are too broad and numerous to be captured in this post. In addition, many of these factors have little to do with currencies (including the Dollar), and thus don’t warrant much space on a blog devoted to forex. At the same time, conspiracy theorists, doomsday predictors, and even some mainstream economists have long argued in support of gold as a hedge against inflation (otherwise understood as currency devaluation). In fact, I am only posting about gold now is because that notion has become much more popular over the last few years, to the point where pundits have come to see the current appreciation almost solely in terms of the decline in the Dollar.

That’s because many of the more conventional factors – the same ones that affect prices for other commodities – suggest that gold prices should be declining. Non-speculative demand (i.e. jewelry, industry) remains subdued as a result of the economic recession. Speaking of which; while there is now some evidence of recovery, it is nowhere near robust enough to support a return to bubble prices. In addition, the International Monetary Fund (IMF) just approved a massive sale of its gold reserves, equivalent to 15% of the world’s annual gold production.

Yet the price of gold remains not only stable, but positively buoyant. According to analysts, this is because of an increasing sense of anxiety about the viability of the Dollar as the world’s reserve currency. Euro Pacific Capital’s Peter Schiff, an effusive source of commentary on the markets, believes the price of gold will skyrocket to $5,000 per ounce. “Schiff’s forecast is based on his view the U.S. dollar is going to collapse under the weight of our massive deficit and reckless policies of the Obama administration, which he compares to the massive spending programs of the 1960s, which paved the way for gold’s ascent in the 1970s.”

Other analysts take Schiff’s view one step further by arguing that a shortage of viable alternative reserve currencies (Euro, Yen, Pound, Yuan, etc are plagued by similar fundamental flaws as the Dollar) makes gold the best candidate to replace the Dollar. Some people even hold the extreme view that the entire fiat monetary system will collapse, with the result being a barter system centered around gold. In any event, people are nervous: “That means a growing number of investors, traders — and, most troublingly, foreign governments — don’t believe in the strength of the U.S. dollar, analysts warn. People buy gold when there’s fear.”

On the other hand, it seems reasonable that gold is appreciating for the same reason that everything else is. In this sense, rising gold prices are hardly remarkable. Silver and platinum, for instance, have risen nearly 50% year-after-year, despite similarly weak fundamentals. There is a danger in connecting the Dollar’s decline too closely with the rise in gold, since the former is largely a function of short-term factors such as low interest rates and increasing risk appetite. “With the Fed confirming that interest rates could be steady for a long time, the dollar may continue to be dumped in favor of higher yielding currencies, which may favor the yellow metal.”

While there’s reason to be alarmed or even angry about deficit spending, quantitative easing, money printing, and unsustainable debt, there’s very little to support the notion that inflation is taking hold. In fact, based on both Treasury bonds and inflation securities, inflation is the last thing on the minds of investors. In addition, while gold represents a conceptual reserve commodity, it’s not very practical. It has very little utility (especially compared to other commodities), and its supply can be easily manipulated by producers and central banks. One analyst explains, “Even a rather wobbly reserve currency is better than gold. Gold is far less liquid than U.S. Treasury securities, costly to store and insure, and above all more volatile in price.”

Still, perception is reality in financial markets. If investors want to see a connection between a weak Dollar and strong gold, they will simply contrive one. But if the Fed raises interest rates and/or the Dollar stabilizes, you can expect gold prices to follow suit. If this happens, it won’t imply that confidence in the Dollar has been restored. Instead, it will only imply that investors can earn a higher return investing in Dollar-denominated assets and no longer need to speculate in gold.

Sunday, September 27, 2009

Dollar Down, Gold Up

Thursday, September 24, 2009

Dollar Down, Everything Else Up

Since March, the financial markets have been characterized by several generalizable trends, which can pretty accurately be distilled into the title of this post: Dollar Down, Everything Else Up. To illustrate just how intertwined these two trends are, consider that on the same day, “U.S. stocks rose, sending the Standard & Poor’s 500 Index to an 11-month high,” and “The dollar slid to an almost one-year low.” Two perfect to be a coincidence. Look at the charts below, which show the performance of the US Dollar and Emerging Market Stocks, respectively. Subtract out the stochastic fluctuations, and you’re left with two mirror images!

In this case, connecting the dots is not difficult. In fact, I don’t know of any analyst that has argued against an airtight inverse correlation between the Dollar and virtually every other commodity/security/currency. A solid explanation can be found in an earlier Forex Blog post “Dollar Under Pressure on All Fronts,” which detailed both the short-term and long-term drags on the Dollar, but I’ll summarize and expand upon it below for those of you who didn’t read the first iteration.

In the short-term, the Fed’s easy monetary policy is one of the most salient factors. It has injected more than $2 Trillion in US capital markets since the start of the credit crisis, and lowered interest rates close to 0%. In fact, the Dollar is now the cheapest funding currency in the world, recently eclipsing Japan, the perennial home of cheap capital. Moreover, US rates are expected to remain low for the near future. According to one analyst, “Congressional elections in November 2010 represent a strong incentive for the Fed to stand pat. That is because going into an election, there often is political pressure to keep rates low and give a boost to the economy.” This belief is reflected clear in US Treasury rates, which remain relatively close to the all-time lows touched in 2008.

In other words, it’s a classic carry trade scenario, with the US footing the bill. Of course, there’s a twist, namely that there’s so much cash floating around the system, that all of it can’t be invested abroad. Hence, the whopping 58% rise in the S&P 500, from trough to present, as well as the recovery in gold, oil, and other commodity prices. You will find plenty of analysts who point to impressive graphs and quote equally impressive statistics to explain these seemingly distinct instances of appreciation. But from where I’m standing, the fact that everything is under the sun (except for real estate, but that’s another story) is rising would lead the proverbial alien watching from outer space to conclude that investors have adopted a bubble mentality, and are once again chasing returns wherever they can be found.

The strongest support for this explanation can be seen in the fact that signs of US recovery have not been accompanied by Dollar strength. By most estimations, the US economy is now stronger (despite the employment picture) than the UK and the EU, at the very least. Yet the Euro and British Pound have far outpaced the Dollar over the last few months, picking up steam once again over the last few weeks.

You don’t need me to tell you that this is a product of risk aversion; that, ironically, signs that the US economy is strengthening/stabilizing causes investors to move capital out of the US economy. If investors were betting on fundamentals, as stock market bulls would have you believe, this would be plain irrational. But the fact is, US economic growth makes investors more confident in global growth, and causes them to turn towards more speculative investments to achieve yield.

In analyzing whether this phenomenon is sustainable, then, it doesn’t make sense to look at the different markets, in isolation. Rather, you must be holistic in your approach, basically by examining whether investors are justified in their overall complacency. If ever it was the case, it certainly is now: perception is reality.

Saturday, September 19, 2009

Bank of Canada Versus the Loonie

I toyed with the title of this post for a while, and ultimately settled on the current iteration, because it reflects the battle that is being waged between the Bank of Canada and the forex markets. Simply, the Loonie is moving in one direction (up!), while the BOC would prefer that it moves in the opposite direction.

Let’s start with some context: the Canadian Dollar’s performance this year has been impressive, to say the least. 2009 is far from over, and yet the Loonie has already risen 14% against the Dollar, almost completely undoing the record 18% slide in 2008. Analysts are quick to point to the nascent Canadian economy, fading risk aversion, and the ongoing boom in commodities prices as behind the currency’s rise.

While all of these reasons are certainly valid, they hardly tell the whole story. Consider that Canadian growth remains tepid, deflation is now a reality, its currency is outpacing commodity prices, and its budget deficit will probably set a record this year. Regardless of what the future holds for the Canadian economy, the present remains nebulous. Thus, it seems the best explanation for Loonie strength is not to be found in Canada, but across the border in the US. Specifically, it is US Dollar weakness, and momentum-driven speculation based on the expectation of further weakness, that is driving the Canadian Dollar.

From the Bank of Canada’s standpoint then, the Loonie’s move back towards parity has nothing to do with fundamentals, which is why the BOC maintains that the currency represents a threat to both recovery and price stability. He has a point on the second front, since inflation is currently running at an annualized rate of -.8%, marking three consecutive months of deflation. “The [inflation information] has proved the Bank of Canada’s concerns are justified,” confirmed one analyst.

The Million Dollar Question then, is how far the BOC is willing to go to halt the Loonie’s ascent. Bank of Canada Governor Mark Carnet has already intervened vocally, by repeatedly signaling his displeasure with recent developments in forex markets, and suggesting that all options remain on the table. But rhetoric only goes so far, and after a brief pause, the Canadian Dollar has resumed its rally. “We think [rumors of intervention] it’s 100 percent untrue. I don’t think the bank has the ammunition or the desire to intervene. This is a story about U.S. dollar weakness across the board,” said one trader.

The Bank has already exhausted most of the tools in its monetary arsenal. It recently voted to maintain its benchmark interest rate at the current record low level of .25%, and beyond extending the period of time during which it maintains low rates, there isn’t much more it can do on this front. Besides, conveying an intention to hold rates at .25% beyond June 2010 might not influence investors, who don’t seem too concerned about low yields offered by the Loonie. Moreover, it remains loath to copy the quantitative easing implemented by the Fed and Bank of England, because of the tremendous amount of work required to mop up“that increase in liquidity when the time comes.

In other words, the only thing the BOC can do at this point is to actually intervene, probably by buying US Dollars on the spot market. A couple obstacles are the fact that the BOC hasn’t intervened for over 10 years, and that Prime Minister Stephen Harper is simultaneously trumpeting the importance of “flexible exchange rates” in speeches intended to denigrate China.

In fact, the BOC may not have to get involved, since the consensus among analysts is that the Loonie will trade sideways for the next year. “According to…52 strategists polled by Reuters…In three, six and 12 months, the median estimate of those polled had the domestic currency steady at $1.100 to the U.S. dollar, or 90.91 U.S. cents.” Moreover, polled analysts based their forecasts on a mere 17.5% of intervention, which means that irrespective of the BOC, most forecasters think that the Loonie has reached its potential…for now.

Of course, if the Loonie fulfills estimates at the high end of the poll – especially in the short-term, and if inflation remains negative, the BOC could find itself with no other choice. But for now, investors aren’t holding their breath.

Thursday, September 17, 2009

Asia (China) Continues to Build Reserves, but Forex Diversification Slows

After a brief pause, the world’s Central Banks (or at least those in Asia) have begun to once again accumulate foreign exchange reserves. I’m not one for hyperbole, but the figures are downright eye-popping: “Reserves held by 11 key Asian central banks totaled $2.625 trillion at the end of August, up from $2.569 trillion at the end of July, according to calculations by Dow Jones Newswires.” Most incredible is that this total doesn’t even include China. whose reserves could exceed $2.3 Trillion by now.

The credit crisis was initially marked by a collapse in trade and an exodus of capital from Asia, as western consumers tightened their wallets and investors flocked to so-called safe havens. As developing countries fought off currency depreciation, forex reserve levels plummeted. Less than a year later, trade has already picked back up, investors have returned en masse to emerging markets, and Central Banks are once again sterilizing capital inflows so as to mitigate upward pressure on their respective currencies. [Chart Below courtesy of Council of Foreign Relations.]

“Taiwan and Thailand, the most aggressive in defending the U.S. currency, have logged record-high reserves every month since December.” Japan, whose reserves are the second highest in the world (after China), is the lone holdout. As the Forex Blog reported yesterday, the newly elected Democratic Party of Japan will pursue an economic policy that depends less on exports, and has pledged to stay out of the forex markets.

The prospects for further reserve accumulation remain reasonably bright, as emerging markets lead the global economy towards recovery. “The outlook for key Asian economies is improving faster than that of developed economies. For the time being, this should accelerate flows into these markets, making it harder for central banks to keep their currencies in check.”

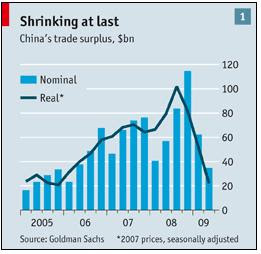

While China’s economy is no exception, its nascent recovery is being driven by capital investment, government spending, and (ultimately?) consumer spending. As a result, it is forecast that “China’s current-account surplus will fall to under 6% of GDP this year and 4% in 2010, down from a peak of 11% in 2007. Exports amounted to 35% of GDP in 2007; this year…that ratio will drop to 24.5%.” If such an outcome obtains, it will almost certainly lead to a slower accumulation of reserves.

While this is all well and good, the more important question for most (forex) analysts is how these reserves are being held. The vast majority of these reserves are still denominated in US Dollar assets, and in fact, the proportion may have risen slightly since the beginning of the credit crisis. Asian Central Banks are particularly biased towards the Dollar, which accounts for 70% of their reserves, compared to the worldwide Central Bank average of 64%.

Moreover, it doesn’t look like plans are afoot to change this trend anytime soon. China has maintained its push (though less vocally) to turn the Chinese Yuan into a global reserve currency, declaring that its capital markets and currency controls will open accordingly to facilitate such. It is in preliminary talks with Thailand for yet another currency swap agreement, to supplement the $95 Billion in such deals signed since December. For its part, the Bank of Thailand has insisted that the Yuan is not even close to challenging the supremacy of the Dollar: “You have to accept that the dollar is going to be a reserve currency for quite some time. You don’t have any alternatives.”

Even China, despite its rhetoric, remains committed to the Dollar. The only talk of diversification in Chinese investment circles is in regards to what kinds of US assets they should invest in, not whether they should be invested in the US or somewhere else. Said the manager of China Investment Corp, which has a mandate to invest nearly $300 Billion of China’s FX reserves, “The risk of a decline in the dollar risks was more of a national issue for China than for CIC because its capital is in dollars.”

This last quote inadvertently confirms that the role of the Dollar as the world’s reserve currency is being treated as a political issue, when in fact it is a financial economic issue. In other words, while many countries want to limit the influence of the US by limiting the power of the Dollar, their Central Banks are stuck with it because it remains the most practical, and advantageous option. Dumping it would be akin to punishing themselves.

Japanese Elections and the Yen

It also aims to spearhead a change in the structure in Japan’s economy, away from big government projects and export-dependent industries, in favor of consumers and small businesses. Through a combination of tax cuts, transfer payments, and certain spending initiatives, it is intended that consumers will feel a greater sense of financial security, and open up their wallets. “If they succeed, firms that cater to domestic consumers, from clothing retailers to restaurants, are expected to prosper.” Given that the unemployment rate just touched a record low and that deflation has now set in, it certainly has its work cut out for it in this regard.

Second, a crisis is looming in Japan’s public debt, and it’s not clear if/how the DPJ can solve it. The spending measures approved by the LDP while its leaders were still in power are projected to bring Japan’s national debt to 200% of GDP, by far the highest in the industrialized world. Some analysts have ascribed a fiscal hawkishness to the DPJ, and believe that despite its campaign promises, it will actually move to rein in spending.

Other analysts are skeptical, and have argued that unless (consumption) taxes are raised, Japan will soon face a crisis of epic proportions. “We have a government coming in that’s committed to spend even more than the previous government at a time when increased borrowing to spend is just not a plausible option…A catastrophic breakdown of Japan’s public-sector finances will be the biggest story ever to hit the world economy in our times, eclipsing the current financial crisis,” said one economist. Given that the the DPJ has promised not to touch the consumption tax rate for at least four years, such a crisis could come sooner rather than later.

Third, DPJ leadership has pledged not to intervene on behalf of the Japanese Yen, as part of its program to re-structure the economy away from exports. This marks a huge shift from the previous LDP administration, whose policies and rhetoric were consistently geared towards helping exporters and holding down the Yen. “I basically believe that, in principle, it’s not right for the government to intervene in the free-market economy using its money, either in stock or foreign-exchange markets,” declared Hirohisa Fujii, Japan’s soon-to-be-appointed finance minster, who has voiced support for a strong Yen policy on the grounds that it will boost Japanese purchasing power. This contradicts his exchange rate policy during his first stint as finance minister, during which he managed repeated interventions on behalf of the Yen. Still, it should be noted that during his tenure, the Japanese Yen rose against the Dollar.

What do the markets think? The Japanese Yen rose on the news of the DPJ victory, which suggests that investors are inclined to give the new administration the benefit of the doubt when it comes to its pledge not to intervene in forex markets. At the same time, Japanese equities sank, consistent with expectations that the DPJ will be less supportive of big business then its predecessors. In the end, nothing is written in stone, and if the Japanese economy fails to revive, don’t be surprised if the DPJ does an about-face and decides that maybe a weak Yen isn’t so bad after all.

Sunday, September 13, 2009

Basics of Forex and Fx Trading

Forex is the largest trading market in the world having an average daily trade of US$ 2 trillion and above. It is a potential platform for earning profit. It moves with the power of currency and is open 24 hours a day except weekends. Now if you are ready to get started with forex or fx trading, the first thing you need to do is to undertake an in-depth analysis of the currency market or forex. An analysis of forex can assist you to assess the best possibilities of trading in forex.

To help you doing the same a few lines about forex are given below:

The forex or fx is a marketplace where one currency is traded for another. The forex is known for its extreme liquidity and high scale trading volumes. It is not confined within big investors or big players of the market but open for investors of all sizes and income level. Hence investors of all kind, irrespective of any status or size are welcome at forex.

Before starting fx trading, you should have a sound understanding of the currency. Major currencies in forex are US dollar (USD), Euro (EUR), Japanese yen (JPY) British pound (GBP), Swiss Franc (CHF) Canadian dollar (CAD) and Australian dollar (AUD). The US dollar is held as the most traded currency in forex which is followed by the Euro and Yen. If you live in a country where any of these currencies is used, it’s good to start trading in forex with that very currency. It’s good as you are familiar with that currency and understand it better than any other.

For a sound fx trading, you should know how to crack the info behind forex quotes. The quotes are usually listed in pairs for e.g. USD/JPY 109.2. This quote is a pair of United States Dollar and Japanese Yen. Here the currency listed first i.e., United States Dollar is called the base currency with a constant value of 1 unit. The latter one is known as counter. The quote exemplifies the relative value of one currency compared to the other.

There are several advantages of trading in forex. However like any other market, fx trading has a few risks also. Now if you can move with a proper understanding of your desired goal and latest information about the currency market, you are likely to earn substantial profits; if not today then tomorrow.

The Best Method of Forex Trading Available Online

If you are trying to make money with the forex you are probably looking for the best method of forex trading online. Naturally you are going to want to invest your time and money into the best method available. But what method will be the best for you is going to depend on your own skill level. It also depends on whether you want to do your own trading or let an automated program trade for you.

I prefer to let an automated program do my trading. I spent several years trading manually but I found an automated program that that makes more consistent profits than I do trading myself and it frees me up to do other things besides sit at the computer and analyze charts. But some people still like to do their trading manually themselves. For those who do it can be exciting and very rewarding once you learn to successfully trade.

If you plan on doing your own trading finding the best method of forex trading online is going to be a matter of personal choice. What might be best for someone else might not be best for you and your trading style. So you may have to experiment with different methods until you find one that fits you and your trading habits.

If you are a beginning trader beware of the trap that many traders fall into searching for the perfect method. Before putting much energy into finding the right method it's going to be more important for you as a new trader to develop your own personal trading habits and discipline. In the beginning just find any simple trading method that you understand and are comfortable with. Practice trading on a demo and don't worry about whether it makes or loses money. Just practice trading the method consistently. After you develop good trading habits then you can start looking for the best method that will be right for you and will make you money.

In my opinion the best method is to use an automated robot. The one I use makes a nice income, doesn't cost much and allows me to spend my time doing other things.

The Best Forex Education For Beginners

There are many options available to get an education trading the forex. A new trader can quickly get overwhelmed by all the information available on the internet. There are all kinds of opinions about what are the best techniques and strategies you should learn. When looking at all these sources it's easy for a beginner to become paralyzed by too much information to choose from. So what is the best forex education for beginners?

There are as many opinions as there are traders who will give conflicting advice as to what strategies and techniques you should be learning. This is what most traders spend their energy on, pursuing that one perfect technique, that one strategy that will make them money. That's why most traders end up spinning their wheels and never see the profits that are available from the forex. As a beginning trader you shouldn't concern yourself too much with techniques and strategies. The best forex education for beginners is education that will focus on you becoming a good consistent disciplined trader.

Until you can become an effective trader yourself, all the techniques in the world are not going to do you any good. Most new traders will continually learn one system and then move onto the next because the previous one didn't work. It's usually not that the system didn't work, it was that the trader wasn't being consistent working the system.

As a beginner you should be doing your trading on a demo account. Find one or maybe two trading systems that you like and just concentrate on trading the system with consistency. Work on not allowing your emotions to affect your trading decisions. Don't worry about whether your demo makes a profit or not. This is just practice time, the goal is not to make money yet, the goal is to become a consistent disciplined trader.

Whether it takes several months or a year or more keep your focus on consistency. After you develop that then you can start working on getting a system that will make you money. Until then if you want to make money you will be better off using automated expert advisor software. This software also called a robot will trade a system for you. Many of them have built in time tested systems that are known to make a profit. These programs don't have emotions or bad habits to overcome. They just trade the system consistently.

You can learn a lot by watching a good robot trade and make a lot of money in the process. If you are interested in trading manually and want the best forex education for beginners, focus your education on yourself and your trading habits first until you become a good trader. If you want to make money now get a robot.

Forex Trading with your Buddy

I do not believe that anyone who has been trading the currency markets for more than a few months will have failed to notice the phenomenal increase in market volatility.

With increased volatility, so we see that trends tend to be of much shorter duration if a trend can be found at all.

If you examine the GBP/USD for example, prior to the credit crisis it had been in an overall up trend from March 2nd 2002 - until October 2007. Well over 5 years.

If you had bought on the 2nd of March 2002, 1 single standard lot (not allowing for the roll over charges) you could have cashed that in on Friday evening October 5th 2007 with a profit of over SIXTY FIVE THOUSAND DOLLARS.

That is a profit of a little under $1000 (per 1 single lot traded) each month for the duration of the trend.

Anyone that actually did this would have absolutely no problem with agreeing the common and often touted phrase - The Trend is your Friend.

Since November 2007 and today, the same pair has been in what can only be described as a complete reversal.

In the past 16 months, the Gbp/Usd has dropped by over 7,500 pips or, to put that in to perspective, for one single standard lot (not allowing for the roll over charges) you could have cashed that trade in for over SEVENTY FIVE THOUSAND DOLLARS.

That is a profit of a little over $4600 (per 1 single lot traded) each month for the duration of the trend.

Now I am not sure about you but for those levels of profit I am willing to at least consider the trend as a possible friend.

Of course, many of us do not trade over such long periods of time but this does not mean that we cannot follow a trend of sorts.

Within each main trend there are smaller trends. These are intermediate trends and are best calculated from a 1 day and 4 hour chart.

Particularly when the markets are volatile, seeking out the intermediate trend is a very useful strategy as the longer term trend can be difficult to properly calculate.

There are many ways to calculate the intermediate trend, but failing all else, the time honoured and trusted method is simply to draw a trend line using at least 3 swing points on the four hour chart.

Perhaps the time is right to introduce a new trading maxim:

The trend may well be your friend, but when your friend is not available the intermediate trend is your best buddy.

Make Money and Maintain wealth with Automatic Forex Software

Money is needed daily and no one is spared from this fact. We need money to fulfill one of our utmost requirements which is survival. We need money to obtain our daily necessities which are our priority. We need food, we need clothing and we need shelter. Over and above, we need cash to fund gas for our car, to pay our bill and to give proper education to our children. The fact is there, money is one of the most vital things in one's life. Due to this inevitable fact, some great thinkers developed a system based on the trading of the world's currency and they termed it as the Forex Trading System.

Forex is the prime factor of financial markets in the world. Forex is characterized by its liquidity, its immensity and its volatility. The market functions continually, 24 hours a day, 7 days a week and 365 days a year, with trillions of dollars traded within minutes. If you are a trader in mind, you would really wish to try the Forex Trade Market. Sincerely speaking, who would not wish to trade in the largest financial market ever existed, bearing in mind the various possibilities it offers as a get rich solution. For this simple but not negligible reason, some developers invented the Automatic Forex Trading Software. These types of software can assist even the less knowledgeable, first time trader in automatically buy and sell currencies on his behalf.

On the other hand, for a speculator, the Automatic Forex Trading Software is meant for you. Most of the Internet Forex Trading site offers free Automatic Forex Trading Software upon sign up. This is not only a promotional issue but is also an inevitable tool. However, this freely offered software is normally limited in features and usually termed as demo or demo account. You are usually required to sign up for a real account to benefit from the full featured trading software.

There exists different Forex Trading Software online. You might consider downloading a demo version, practice for a while with the associated demo account and afterwards think about buying the fully functional version. Without any doubt, as a speculator, Automatic Forex Trading Software is of utmost importance.

There are primarily two kinds of Forex software, the web-based program and the desktop-based program. Whichever your choice may be, the one point to note is that it is primordial to have a high, uninterrupted internet connection.

While using the desktop-based Forex Trading Software, all information collected is stored on your hard drive. One should take necessary actions to protect those data from virus, hackers and other unauthorized users. Never store your password on your personal computer. On the contrary, it is not required to download any software while using web-based Forex Software. security concerns are the preoccupation of the service provider. Another advantage of using such web-based system is that you can access your account anywhere and anytime. However, one drawback of the web-based Forex Program is that a monthly maintenance fee is generally associated to it.

To conclude, we can deduce that both the web-based trading software and the desktop-based trading software have strengths and weakness but are both meant for one and the same purpose. One should base his choice on his lifestyle since desktop-based Forex Trading Software may not suit the needs of a regular traveler.

Turning to Forex, The Right Way to Make Money

Under the present economic turnaround, nothing seems secured. Economy which is being riddled by high unemployment rates, bank bailouts and loan defaults put the whole world into uncertainties. The big question is, "Are there opportunities where one can invest?" When come to investing the two areas that always pop up are the forex market, stock and the commodity market. Now, where do you invest? You really have to weigh out the ins and outs, the good and the bad, advantages and disadvantages. I have my own way of analyzing the situation where I applied the SWOT analysis concept. SWOT by the way stands for Strength, Weaknesses, Opportunities and Threat.

Strength.

The Forex market is open for trading 24 hrs a day, 7 days a week, 365 days throughout the whole year. Forex trading involves exchanging of one currency for another i.e. it is based on currency rates. Investors can make money either in a bullish or a bearish market. Trading in the Forex market can be made more simpler by automatic signal services which measure and then predict the trends for a particular currency pair. Brokerage and commission fees hardly exist in Forex market and you get all of the profit. With internet around you can do all your trading automatically and online.

Weaknesses.

The Forex market is not widely publicized. In other words, not much information is readily available. Not many people will understand it. The profit margins are extremely small.

Opportunities

Around 2 billion dollar worth of currency turnovers are happening everyday. Isn't this a great opportunity? With a little investment and the right frame of mind, with the right attitude that is, one should jump into this wealth of opportunities. Technological advancement, along with liberal market sentiments, has allowed almost everyone to deal in currency trading, unlikely to the past when there were only few organizations that could trade the currency.

Threat

Forex trading has its own set of rules and that if you don't understand them, then you could easily suffer a margin call. The reliability and reputation of a forex broker causes the dangers of forex trading. The currency trader should check the reliability and reputation of the brokers before they get in trade with their assistance. The unpredictable and volatile nature of the market makes it more complex to avoid risks even if you choose a genuine broker. In simple terms, the risks involved in forex trading relate to the rate of exchange of foreign currencies, the interest rate, the risk according to country and credit risk.

Based on the above analysis I would go for Forex market. Being more in strength and opportunities, one should opt for Forex market.

Now is the right time to switch over to Forex. There are numerous Forex Autopilot Systems that are available on the internet to help you with the trading. One has to be careful though when choosing the right system. Always be wary of scams. To save time go for review sites where options are given fairly to potential traders.

How can you Succeed in Forex Trade?

People these days are trying many options to get more money. There are many ways to do that but people are not content with just getting it conventionally. They want it fast, easy and in big amounts. For that reason, many are resorting to the forex market. In forex market, money is indeed fast but not really easy. Many websites and software developers are advertising the forex trade as an easy thing to do. They may be right in some ways but in reality, the forex trade is as difficult as any business if there is not enough knowledge and expertise that goes with it.

Succeeding in the forex trade is for people who take time to study the system before jumping in. There are people who have bad experience regarding currency trading because they act too soon. Forex trade is really not for the amateur who knows nothing about how the business works. It would be best to start learning the system first and all the things connected with it before ever deciding to engage in any trade. Forex trade is different from other trades. It requires tools and analysis. Knowing the system is definitely a plus.

One of the very recent changes in the system is the Forex options. This gives the trader the ability to control his forex trade and the risks involved. Forex options greatly reduces the risk involved in a forex trade. The trader will have the ability to buy currency based on observable facts about the options. Losing is not so much of a problem for the trader because the only money at stake is the premium he paid.

Forex Trading System - The One Enclosed is FREE and Works

Here I am going to give you a free simple trading system, that over the last 20 years has made traders countless millions of dollars and the system was devised by a trading legend. If you want to win at forex here it is...

Forex robots and trading systems have a bad reputation as most don't deliver gains and lose.

You will see them online all the time, slick advertising and no substance. The track record that is supposed to show how good and profitable the system is doesn't add up in reality. It's always back tested and the track record is paper money and of course in reality, you don't get paid for knowing what happened, you get paid for timing your trading signal correctly without knowing the price.

This system however is based on a simple phenomenon which is easy to understand and that's - currencies trend for weeks, months or years and most of these trends start from and continue from market highs.

This will never change just look at any forex chart for the evidence but how do you turn these forex trends into profit?

This system will do it and was devised by trading legend Richard Donchian. It's only got one trading rule and here it is:

Buy any new 4 week calendar high and sell any 4 week calendar low and maintain a position in the market at all time.

That's it! Simple and objective and any trader can do this its easy and it works.

Do not be fooled by its simplicity, it works and will continue to work.

Forex trading is essentially simple and complex systems tend to break in the real world - simple systems are more robust and you won't get a much simpler system than the above but it will make sure you catch and hold every major trend.

Its only downside (and all forex trading systems have one) is in a non trending or choppy market where it will of course get chopped about and lose but you can overcome this and smooth the equity curve...

The way to do this is to trigger new positions on the 4 Week Rule - but add a stop level at the 1 or 2 week level and go flat. You then wait for the next 4 week trading signal to get back in the market.

Countless traders over the years have used this system as a basis for there trading but it is quite hard to follow even though it works.

1. It is not fussy about exact, pinpoint market timing and many traders are obsessed with this

2. It is brutally objective and most traders have a problem following trading signals with discipline

3. It requires tremendous discipline and patience to follow it

If of course your just interested in making money, it will deliver long term profits - it always has and chances are it always will, unless currencies stop trending and that is unlikely to happen.

So if you want a trading system that works, is based on sound logic and is simple and easy to use and takes less than 30 minutes a day to trade, you will love this forex trading system, check it out and you will surprised at how profitable it can be.

Forex Trading Tips That Can Increase Forex Business

No one on earth can deny when he is offered a chance to become a millionaire. This can be turned into reality only when the stock market makes its debut. But it is always an uncertain thing for a stock market analyzer to expect an ever-increase in the market trends. Market analysts state that the stock market tends to rise or decline based on the activities performed by the investors. But one can always obtain good profits if the analysis of the market is done carefully.

Getting hold of the stock market just before it falls down can make an investor to remain in the safe grounds. But the truth is that there aren't any key or principles that can help an investor to analyze the market's behaviour. But one can always take few safety measures and strategies in order to keep himself from losing his investments.

Fundamental indicators can be your help to analyze the market's behaviour. A valid and efficient indicator can work at all periods in all markets. The indicators help you determine the good entry points into the market including the aspects that determine the best 'sell' and 'buy' positions. Also an indicator helps you to get assured of the changing trends including the resistance and support levels. These trends are nothing but the simple price fluctuations that are predictable but not random.

Though you have good indicators to help you analyze the market's behaviour, you also need a good Forex trading strategy that can well use these Forex indicators in determining the market and making the appropriate calculations about it. A good Forex trading strategy is the key to a successful online currency trading (or Forex trading, in other words). Profit or loss in your Forex business is majorly determined by the strategy that you employ in your Forex trading.

Though there are many Forex trading strategies out there in the market, all of them can be classified into two broader categories. Any Forex trading strategy can either fall under profit maximizing category or under risk minimizing category. Leverage can be considered as the popular form of profit maximizing strategy as it helps an investor to trade in the Forex market with more than what he has in his account. On the other side, stop loss order can be considered as the popular form of risk minimizing strategy. With the help of this strategy, one can limit their losses by imposing limitations on their trading price.

Forex Tracer - The Ideal Forex Trading System

The currency market, or the forex market, gives many profiting opportunities for people. It operates twenty four hours a day, it does not suffer from long down periods, and it can create a profit regardless of market direction. The forex market has one more big advantage - it can be traded without any effort with an automated trading system. One such system is Forex Tracer, which seems like the ideal system.

First, it comes from a well known media group: NC Media. This group is well known for their high quality products and service. Their product description pages and download pages are top notch, and the Forex Tracer pages are not different. After purchasing their Forex Tracer, you are directed to a well explained download page with everything from the download link to a technical support address. This step ensures there is no scam in this system.

Easy installation also makes this system ideal. After downloading a little zip file, installation is the quickest thing you can do. The instructions manual is very detailed, and after the installation of MetaTrader 4, the system which Forex Tracer uses, you begin profiting within about five seconds. It can connect to most brokers, even some not popular brokers.

The biggest advantage of Forex Tracer is its ability to trade both uptrends and downtrends. After careful testing, most traders noticed that the direction of the market does not matter to this system. Money is coming regardless of market direction and the value of the United States dollar. There is always money to be made.

The Cherry Picker is sealing the decision about Forex Tracer. It is a custom set of forex indicators which works wonderfully. Traders who used these indicators claimed that a big portion of their profits came from them. The Cherry Picker comes with Forex Tracer at no extra charge.

All these reasons make Forex Tracer the ideal forex trading system. Every trader who wants an automated trading system should consider it as one of his trading tools.

To see Forex Tracer in action and download it, read the Forex Tracer review at Great-Info-Products.com.

About the author:

Nadav Snir is a stock market trader and forex trader. You can find more information about forex trading and forex brokers at his site at http://Great-Info-Products.com/Forex/index.html.

FX Trading Strategy - To Win it Must Contain These 3 Vital Elements

If you want to win with your FX trading strategy make sure it contains these key elements otherwise you will be doomed and join the 95% of losing traders.

1. It must be Your Strategy!

Don't fall for the hype that some junk robot will give you success or a guru or mentor there are plenty sold online with huge profits in simulation but they don't work - no one gives you something for nothing and forex trading is no different.

Even if you have got the forex education from someone else, you must understand it and have confidence in it so you can follow it with discipline - discipline is the key, you must be able to ride out losing periods and wait until you hit a home run.

If you don't have confidence you will never be able to do this make sure you have it.

2. You Must Understand Your Edge

Your trading edge is the reason you will win when 95% of other traders lose and you must have confidence and understand what it is and it must be based on sound logic.

Many people think they have an FX strategy based on sound logic and do the following and lose.

- They try and predict market prices

- They follow bogus scientific theories

- They trade news stories

- They day trade and try and scalp

- They follow experts

All the above will see you lose if you don't know why, continue your forex trading education until you do.

Your trading edge is something that is personal to you and can be based on a simple forex trading strategy you can execute with discipline - that's enough, remember simple systems executed with rigorous discipline work!

3. Play Defence First

When you are trading on leverage you need to trade great defence first and always protect what you have this means rigorous money management rules and money management is much more than placing a stop!

If you don't keep your losses small you will get wiped out - sounds obvious?

Well most traders don't heed it and use leverage of 200 or 300:1 on a few hundred bucks, 10 or 20 is enough.

Forex trading can make you a lot of money but if you expect not to have to work your in for a rude awakening.

Do your homework, get confident and make sure you have the discipline to stick with your FX trading strategy and follow it through drawdown periods, to long term success and the rewards if you can do this are huge.

NEW! 2 X FREE ESSENTIAL TRADER PDFS

ESSENTIAL FOREX TRADING COURSE

For free 2 x trading Pdf's, with 50 of pages of essential info and more on FX Trading Strategies visit our website at: http://www.learncurrencytradingonline.com.

Make Money Trading Forex

INTRODUCTION

There are various methods to invest your hard earned money without having to rely on mutual fund portfolios, stocks or banks. With today’s market headed in the wrong direction, it’s just simply not safe or viable to invest your money in the stock market unless your a seasoned and experienced investor. So where should you invest your money? This article will explain how trading foreign currency can be a very profitable and satisfying investing experience. This article will detail the steps required in teaching yourself how to trade foreign currencies, what online resources are available for you to reference, which online brokers to open an account with, what kind of account to open and what kind of experience is required. After reading this article, you should have a better understanding of how you can use the foreign currencies market to invest your money.

STEP#1: Learning To Trade Foreign Currency

All it takes to trade currency is some spare time to teach yourself the basics and the motivation to be a successful investor. There are a vast amount of online resources which help teach you how to trade foreign currency. Learning what you’re getting yourself into is absolutely vital. All you really need to get started is a computer and a high speed internet connection,.

The best online resource I’ve been able to find that virtually breaks down every aspect of currency trading into easy and user friendly modules is http://www.a7laweb.blogspot.com/. This site breaks down currency trading perfectly and structures its offerings into different classifications, such as kindergarten (Beginner) to University (Expert). Following the www.a7laweb.blogspot.com forex education program will give you all the necessary information and education you need to dip your feet into the forex world. The course itself is quite lengthy and requires an initial investment of your time. I can honestly say from experience, that this investment was one of my best. I took the time to read over the course and familiarize myself with the currency market. The foreign exchange market trades 1 trillion dollars worth of currency everyday!! Learning how to take advantage of the currency market is a great investment opportunity Taking this course will also distinguish if this investment method is right for you or not.

Automated Forex Trading Robots

Automated Forex Trading vs Manual Forex Trading

Forex can be traded in a number of different ways, and in this article we discuss the basic differences between automated trading using forex robots, alias forex expert advisors, and manual trading.

What are the Differences Between Manual and Automated Forex Trading

The Foreign Currency Exchange (FOREX) market is the largest and most liquid financial market in the world. But, in this huge market, at least 90% of new FOREX traders lose all their money within their first 3 months of trading. Why? People who enter the world of forex is commonly of a fairly high intellect, however, they usually lack the right tools to make profits in the long run. The right tools does not neccesarily mean for instance analytical tools, but rather tools that take away the "human-factor", for we as humans have a number of inherent weaknesses that make us seem almost self-destructive.

FX Automated Trading ReviewsLet's discuss a few human weaknesses...1. Greed. Many times we have a 1% profit, but we feel it is not enough. We want more, 2% or 3% will be better. When the profit really goes to 3%, we will think how about 10%? It's never enough. But the forex market is so volatile, and profits can and often do turn into losses.2. Fear. Fear of losses is often the cause for people to make irrational choices and end up losing all their money. 3. Lack of confidence. A lack of confidence can mean taking a small profit on a trend that goes a very long way, and making larger losses all the time. A lack of confidence is the opposite of greed in this case, but a good trading strategy should dictate where entry and exit points are even before the trade is made.4. Hesitation. Hesitating and not sticking to your plan can be detrimental to your trading performance. Not only does it mean that you might get confused when thinking too much, it also means you loose that vital window of opportunity that would maximize your profits. 5. Weariness. Taking a break is something we all need every now and then. However, taking a break in the fast-paced world of forex can often be the difference between making a profit and a loss. 6. Negligence. We often neglect to pay attention to the smaller things in life, and more so do traders often neglect to pay attention to the minute details of every trade. This can lead to constant losses as every bit of detail often proves to be vital.7. Lack of discipline. Forex trading is often compared to fighting in a war, as you need absolute confidence in both or you will almost definitely perish.

Forex Robot ReviewsTo overcome these terrible weaknesses of humans, people have developed many methods. One of them is called "Automated Trading". Automated (or Automatic) Forex Trading means to trade Forex (Foreign Currencies) using some trading systems, programs, software or robots (on Metatrader MT4 platform it is called as Expert Advisors - EA), without needing a human to physically trade.An automated trading system is a group of specific rules and parameters, governing entry and exit points, having the ability to both generate signals and execute trades automatically. There are many advantages in Automated Forex Trading: 1. Automated trading is executed by computer. Computer technology advancements mean that computers can now process millions of times as many calculation per timeframe as humans can, giving them a clear advantage in the fast-paced world of forex.2. Taking the emotion out of trading. Computers do not trade based on emotions. Period. They only trade based on a certain set of criteria that was programmed into their algorithms.3. Automated trading can take trades day and night, non-stop, no weariness and negligence. EA robots free their owners of the necessity of sticking in front of the computer at all times. Once an effective system is developed and optimized, it can be left to run full automatically and independently. A successful automated trading EA robot will allow its owner to focus on optimizing strategies and money management rules rather than having to constantly watch the market. 4. Computers can run multiple programs simultaneously, so we can use automatic trading EA robots to take multiple trades synchronously. We cannot monitor multiple currency pairs over multiple timeframes all at the same time, yet computers can, and what's more is that you can even run multiple different ea's on the same computer at the same time.5. For day traders or other short term trading fans, automated trading robots are very helpful tools to deal with the high frequency of trades using tick data. Day trading keeps traders exposed in the market very shortly, so sometimes it is safer than long term trading, but it is really difficult for a human to handle. However, for automated trading EA robots , it is just a piece of cake. 6. No whether you are doing long or short term trading, the forex market is always volatile and moves fast, only automated trading can afford faster identification of signals and reaction to them. No doubt, computers will typically beat human beings in the speed of identifying a trading signal and the entry and execution of the corresponding orders. No more missing a trading opportunity.

FX Automated Trading Reviews

Forex Market

History, Size, Location, and Users

As the world’s largest financial market, the forex trading market moves the global economy,

sometimes seeing over USD $3 trillion traded each day.

Forex Market History

Historically, the forex trading market was reserved for central banks, commercial financial institutions, and multinational corporations. However, with the advent of web-based trading applications, small retail traders and even individuals can now participate directly in the forex market on equal footing with these large institutions.

The forex market is an inter-bank or inter-dealer network that was first established in 1971 when many of the world’s major currencies moved towards floating exchange rates (as opposed to fixed rates). It is considered an over-the-counter (OTC) market, meaning that transactions are conducted between two parties that agree to trade by phone or over an electronic network.

Forex Market Location and Hours

Unlike some equity stock markets, such as the New York Stock Exchange (NYSE) or the Chicago Options Board Exchange (CBOE), where options and futures are traded, OTC trades are not centralized in one location. Currently, London, England contributes the greatest share of transactions with over 32% of the total trades. Other trading centers—listed in order of volume— are New York, Tokyo, Zurich, Frankfurt, Hong Kong, Paris, and Sydney.

Since these trading centers cover most of the major time zones, the FX market is open 24 hours a day, five days a week. For example, traders in New York can start trading on Sunday evening when the market opens in Sydney, and continue trading around the clock as the other trading centers around the globe come online. The week finishes with New York closing at 4:30 PM EST on Friday and starts up again on Sunday evening, when Sydney reopens for trading.

Forex Market Size

The FX market has become the world’s largest financial market, sometimes seeing over USD $3 trillion traded each day. The NYSE—the world’s largest equity market—is dwarfed in comparison, reporting daily trading volumes in the USD $60–$80 billion range. Even when combining the US bond and equity markets, total daily volumes still do not come close to currency market figures.

The most commonly traded currencies are the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), Great Britain Pound (GBP), Swiss Franc (CHF), Australian Dollar (AUD), and Canadian Dollar (CAD). The sheer volume of trading completed every day in the FX market makes it by far the most liquid and efficient market available. Because of the magnitude of trades, it is virtually impossible for individuals or companies to influence the exchange rate of the more commonly traded currencies through any form of open market operations. No single individual has the resources required to manipulate pricing through targeted buying or selling on the market.

Who Uses the Forex Market?

Individuals and organizations use the forex market at various times.

Consumers and Travelers

Consumers typically need to exchange currencies when they travel or purchase items from foreign vendors. While travelers go to banks or currency exchange offices to convert one currency (typically, their home currency) into another (often the currency of the country they intend to travel to) so they can pay for goods and services while abroad. Travelers need to be aware of exchange rates to ensure they receive a fair deal.

Consumers may purchase goods in a foreign country or over the Internet with their credit card, in which case the amount they pay in the foreign currency is converted to their home currency on their credit card statement.

Although each consumer currency exchange is a relatively small transaction, the aggregate of all such transactions is significant.

Businesses

Businesses typically need to convert currencies when they work outside their home country. For example, if they export goods to another country and receive payment in that foreign currency, then the payment must typically be converted back to the home currency. Similarly, if they have to import goods or services, then businesses will often have to pay in a foreign currency, requiring them to first convert their home currency.

Large companies convert huge amounts of currency; for example, a company such as General Electric (GE) converts tens of billions of dollars each year. The timing of when they convert can have a large effect on their balance sheet and bottom line. To offset the potential negative effects of currency market volatility and ensure they do not incur losses over time, many businesses use hedging strategies.

Investors and Speculators

Investors and speculators require currency exchange whenever they trade in any foreign investment, be it equities, bonds, bank deposits, or real estate. For example, when Swedish investors buys shares in Sun Microsystems on the NASDAQ, they will have to pay for the shares in U.S. dollars, likely converting Swedish Krona to USD in the process. Similarly, a Japanese real estate investor who sells a New York property may want to convert the proceeds of the sale in U.S. dollars to Japanese yen.

Investors and speculators also trade currencies directly in order to benefit from movements in the currency exchange markets. For example, if an American investor believes that the Japanese economy is strengthening and, as a result, expects the Japanese yen to appreciate in value (go up relative to other currencies), then she may want to buy Japanese yen and take what is referred to as a long position. Similarly, if an American investor believes that the euro will go down over time, then she may want to sell euro to take a short position. Interestingly, investors and speculators can profit equally from currencies becoming stronger (by taking a long position) or from currencies becoming weaker (by taking a short position).

Speculators are often day traders, trying to take advantage of market movements in very short time periods, buying a currency and then selling it again within hours or even minutes. They are attracted to currency trading for numerous reasons:

The size and daily volatility of the market, which provides some individuals with an unparalleled level of excitement.

The almost perfect liquidity of the currency exchange market.

The fact that the currency exchange market is "open" 24 hours a day.

The fact that currencies can be traded with no brokerage charges.

Forex Online Trading

The Basics of Trading the Forex Market (Foreign Exchange)

Basics of Forex online trading to help you get started. Foreign exchange market terminology is provided.

Before you begin trying to trade the Forex (foreigh currency exchange), you should be familiar with the main terminology and ideas used in this market.

PipPip stands for "percentage in point". This is the basic unit of price in the Forex market. This is similar to stocks, for example, which use dollars and cents to as the base numbers. Pips can refer to the number of ticks or units a currency pair has moved. For example, assume you are trading the EUR/USD (the Euro Dollar and US Dollar) pairing. If the price has moved up from 1.5480 to 1.5485, that is a 5 pip movement.

A pip is also a unit of money you are trading. A standard lot is based on a 100,000 units and each pip is valued at approximately $10.00. Typically, to trade a standard lot, you will need approximately $1,000 per lot (or unit). Using the same example, that 5-pip move up would have been equal to a $50 move. There are also mini accounts that allow you to trade with much less capital, while also reducing the pip value. Typically, most brokers with mini accounts will base their mini lots on 10,000 units per lot, with a pip value of approximately $1.00 per pip. With mini accounts, you will need approximately $100 per lot/unit you want to trade.

LeverageLeverage trading, or trading on margin, means you do not have to put up the full value of the position. As mentioned above, a standard lot is worth approximately $100,000. If there were no leverage involved (or a leverage of 1:1), you would need to deposit the full amount to trade one lot. However, all brokers will offer you leverage of 50:1 to 400:1.

While more leverage makes it much easier to trade more lots, there is a danger with it as well. Think of leverage as a double-edged sword. Yes, it can help you control more money, but if you have a loss, you can also lose more of your own money.

Here is an example: assume you have $5000 in your account. Your broker offers you 100:1 leverage. This means that you can trade up to 5 lots and control $500,000 worth of currency. This also means that for every 1 pip in price movement, you will gain or lose $50. Remember, typically for every $1000 in available margin at 100:1 leverage will control $100,000 in currency and that every pip (i.e. price movement) will be worth $10.

Using the same information: if a broker were to offer you 400:1 leverage, then your $5000 would be able to control $2,000,000 in currency. This gives you the ability to trade 20 lots at a time, which means each pip movement would be approximately $200…so that 5-pip movement from above would equal to a gain or loss of $1000!

So, you can see that while a higher leverage can help you control more currency and give you the ability to make more money, if you are wrong, you will lose more. Take the use of leverage seriously and with respect and you are already ahead of the game.

Margin CallYou never want to get one of these. Basically, a margin call is when you are contacted if your account falls below a certain level (you will know that level that is when you open your account with your broker.)

Here is a simple example: You open an account with $2000. You open a position with one lot. You have now have only $1000 in usable margin to either open another lot or to buffer any losses you had on your first open lot. Let’s say that you use that remaining $1000 to open another lot. You now have $2000 of USED margin, with ZERO remaining usable margin. Your trade goes against you by 10 pips (which with 2 lots is $200). Depending on your broker, they will either automatically close the trade and you will have nothing left in your account or you will be contacted via phone or other means saying you must deposit additional capital to cover the deficit. Fortunately with most Forex brokers, your risk is limited to the funds you had on deposit.

Price Quotes: Base Currency / Quote CurrencyAll transactions are based in pairs, buying one and selling another. The first currency quoted is called the base currency, while the second one quoted is called the quote currency. As an example, here is a typical currency quote: EUR/USD 1.5280

In this example, the base currency (EUR) is the Euro Dollar and the quote currency (USD) is the US Dollar.

So, using this example (if you were buying), the quote of 1.5280 means that you would have to pay 1.5820 US Dollars to buy 1 Euro Dollar. Conversely, if you were selling, you would receive 1.5280 US Dollars for each Euro Dollar you sold.

SpreadThis is also called the bid/ask spread. This is the price difference between what a currency pair is being bought and sold for…or a difference between the bid and offer price.

The bid is the price at which the Forex market maker is willing to buy the base currency in exchange for the counter currency. On the other hand, the ask price is the price at which the Forex market maker is willing to sell the base currency in exchange for the counter currency.

Remember that all trades involve the simultaneous purchase of one currency and the sale of another.

Spreads will vary from pairings to pairings. This spread is where your broker will make their money. Every time you make a trade, they make the spread. This is why they charge no commission – because there is no need for it.

Forex Currency Trading - FOREX

Forex is the only market in the world which is trading around the clock. 24 consecutive hours. Speed in completing the transactions, the cost is very low, liquidity is high. All these factors make foreign currency trading market (or the foreign exchange market), more exciting for the market traders. The market for trading currencies that can not be equated with market share trading in terms of form, here, there is no known stocks the traditional sense of the word. But is composed of a huge global network is simply connecting a large number of currency traders in the world. Here are hundreds of trading between the banks over the phone or via the Internet.

The major currencies traded are: the U.S. dollar, euro, pound sterling, Japanese yen, Swiss franc, in addition to all the currencies of the world. How it works currency trading: In this market you can buy or sell currencies. Objective is to profit from the value of your contract. The implementation of the debate in the currency market is easy: a mechanical trading is the same in other markets, making the transition to a market exchange easy. The five largest centers are traded between banks, which account for two thirds of the volume of global exchange are: London, New York, Zurich, Frankfurt and Tokyo. Who are the players on this scene? 1 international banks. It is no secret to anyone that the banks are the largest and most important players in the arena of global trade in currencies. Are conducting thousands of transactions daily around the clock, which they exchange among themselves, or with Albrookr Aoualemsttmaren ordinary, through the permanent representatives in this area. It is well known that the biggest impact in moving the market and to identify and exclusively in the hands of his senior international banks, as their transactions amounting to billions of dollars daily. 2 Central Banks. Central banks conduct their transactions in this market on behalf of their governments, which often move in to influence the course of the direction taken by the private currencies, according to the interest to be consistent with financial policies, and thus protect its economic interests. 3 investment funds. Is due mostly to the institutional investors or pension funds or insurance companies, interfere in the market, according to the dictates of their interests. Recall the most famous of these funds, "H", a fund owned by renowned investor George Soros, who wrote a history in this area is still considered one of the largest direct investors who are able to influence the course of the market. 4 clients trade currencies. Important of these are limited in linking between buyers and sellers. In other words they are moving from the point as mediators between the different banks, the other hand between the banks and ordinary investors. In return for their work that they Ihzbon commission, or the so-called Brockerj. 5 independent people. These are ordinary people who have huge daily turnover of currency to finance their trips planned, or to secure access to their salaries, or at retirement, and so on. Today, the impact of the revolution that brought the Internet to the global communications and, after the successive collapses in the stock markets, and under the influence of the foggy atmosphere, which the Treasury bond markets in the world, is growing little by little the role of the independent dealers who have modest amounts of money in buying and selling daily, "the Day Trader. " Growing influence and grow the market in foreign currency exchange, so that many of them are engaged in this work, and spend their days in front of computers and buy all the selling, according to his vision of the course of today's events Circulation around the clock. As previously stated, the work on the currency markets over the past 24 hours. In the Calendar Today the most visible, start first in the Far East, in New Zealand, then moved to the role of Sydney in Australia, then to Tokyo and from there to Honkkong, Vsingaporp, and then Moscow, Frankfurt, London and finally New York, Flosse Angeles. Begin the work of foreign currency traders in Western Europe, seven in the morning. In the eighth in the work. It is necessary to devote the first half hour each day to analyze the market conditions, and study the latest developments of the day to bring about substantive, technical art, after which access to the new daily newspapers, or the exchange of information and contained the leak to the market, which could influence the course of the market. And thus have a clear idea, from which today's program, which is applied must be adjusted if needed to be the work of the day.

Forex technical terms

Ratio / quota or quota Rate is the rate of currency compared with the others. Key currency The base currency is the first currency in any exchange of my husband. Determine the value of currency in exchange for the interview. (For example, if the ratio of the exchange pair Euro / U.S. $ 1.3525, the euro is the base currency and the value of 1.3525 U.S. dollars). The counter (also known as the indicative price or a point).

The counter is the second currency in any exchange of my husband. And define the basic value for the currency. value. (For example, in the exchange pair is the next Euro / U.S. Dollar currency, the opposite is the U.S. dollar). Offer price (also known as the purchase price)) Offer price (the price to give the area the left) is the price at which traders buy the base currency. If you think that the value of the euro will go down if you choose to buy - you can buy the euro price of the dollar before the indicative price given. Rate of demand (also known at the sale price or demand) Demand the application rate (to give the region the right price) is the price at which dealers sell the base currency. If you think that the value of the euro will rise if you choose to sell - could sell the euro to the dollar before the U.S. price in the price of the application. The difference between the price of supply and demand.) Points (also known as points) One point, 0.0001 of a unit, Journal of Trading Trading is open daily and close deals on the same day of trading. The cost of trading The cost of trading is the price when trading against. Calculated in this way the cost of trading = sale price - purchase price Avoid loss Type of Trade Center to close upon the arrival of a fixed rate to avoid a sale of the loss. You can choose to sell to avoid the loss to reduce the loss when the market affected by the opposite of what you expect. The margin of Is a sum of money placed in trust as collateral to cover possible future loss. Leverage (× 400) Lifting Almaliho get a loan from the seller or dealer, and then you can do to a business transaction fast and cheap, a small amount of the capital. Expressed as a percentage of total capital (located) and real capital (which is the amount of money we borrow). (Eg, 1:400, which allows the lifting of financial purchase or sale of 10000 U.S. dollars to 25 U.S. dollars). Please Note Trade currencies on margin, or lift more than a purchase. If you have 25 dollars in cash in the calculation of the margin has 400:1 Leverage, you can buy the currency value of U.S. $ 10000 that you have to put 0.25% of the purchase price as collateral. This means that while you have 25 dollars in cash and now you have 10000 dollars value of the purchase. On the other hand, while the purchasing power of your profitability more than it increases the Ksartk. We advise you to take the advice of very little time to understand the risks. Make sure to read the margin agreement in order to understand how it works for calculating the margin, and ask questions when going through things is not clear to you.

Sitting on the Fence – China and England Watching the Economy Go By

The Chinese stock market has all but collapsed the past several weeks, falling off nearly 25% in a six week span overall, capped by a 6.7% drop yesterday. The causes for concern in the Forex world relate specifically to the Dollar.

As you might recall from several weeks ago, I spoke of the Chinese selling off some of their US treasuries and diverting that money to support their commodity purchases.

This tactic is proving to be detrimental to the short term stability of the Chinese economy, as with the information on the stock exchange shows that industry is not moving, which means the metals and durable goods they are buying are sitting in warehouses, instead of feeding the economic machine.

For the US Dollar this is a signal that could spell out a difficult Fall/Winter once again, as China commits more money to helping their own corporations and diverts more and more funds away from Treasuries.

Already, the US has held three Bond issue auctions in which the Chinese bought nothing – a fact that is not getting as much attention at this stage as it should. I would bet, since my blogs have been a few weeks ahead of the mainstream news, that this will become a bigger deal in the coming months, as more auctions go by and China continues sitting on the sidelines.

Aside from this, we have the British Economy which is sputtering along, as it seems the politicians are doing nothing. Political sensitivity aside, the Sterling has been suffering because the establishment in Parliament is still trying to get over a spending scandal which dominated the headlines for two months. They are timid and afraid to do anything significant for fear of more backlashes, so they are also sitting and watching.

What Forex investors need is a clear sign from governments, that they are doing something, being proactive and working to turn the economy around instead of hoping that it will all by itself.

This week will be a slow one, many in the US are off for the week, and Europeans are spending the last week catching the remnants of the summer sun. The ECB meets this week – don’t look for anything shocking there – they too are catching rays.

Dollar experiencing a Seesaw Ride